Debt consolidation and refinancing

If you have more than one loan, it may sound like a good idea to roll them into one consolidated loan. Debt consolidation (or refinancing)

If you have more than one loan, it may sound like a good idea to roll them into one consolidated loan. Debt consolidation (or refinancing)

Key takeaways Insight into the various pros and cons of each of the three main options for your retirement savings – account-based pension, lump sum,

As our family members or friends get older, it’s normal to worry about them and want to help. But it’s not that easy to know

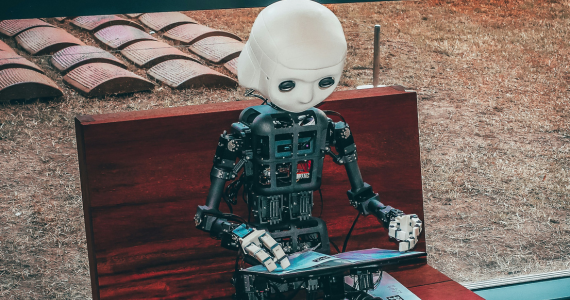

Key takeaways How Artificial Intelligence (AI) is currently being used to shape investment decisions, with applications such as sentiment analysis and algorithmic trading. The AI

Tax breaks are always good news, but for house hunters they can have an added bonus. Not only do tax cuts mean potential buyers have

Teaching kids about money The truth is, adulthood is rife with financial challenges. The more prepared your children are, the better. From budgeting and saving,

The super changes from the start of the 2024-25 financial year. A number of superannuation changes came into effect on 1 July 2024 and are

With less than a month to go before the end of the financial year (EOFY) rolls around, some important tasks need to be completed for

Rather than worrying about day-to-day price movements, focus here instead. If you checked on the status of your investment portfolio today, don’t worry. You’re definitely

The rules around making some types of super contributions have been relaxed in recent years, so it’s worth exploring the different opportunities available to you

Key takeaways From 1 July 2024, the SG rate which determines the minimum percentage of your salary that your employer must contribute to your super

Key takeaways How a few small, simple actions can make a big difference to your relationship with money. Tips to improve your money management and