Effective ways to grow your super

Key takeaways: Tips to maximise your super returns, such as account consolidation, fees comparison, and choosing investment options. An overview of government services available to

Key takeaways: Tips to maximise your super returns, such as account consolidation, fees comparison, and choosing investment options. An overview of government services available to

Binary options promise quick, high returns. But the reality is you will lose your entire investment most of the time. Binary options are financial products

Key points: Getting an assessment is the first step towards getting access to Government funded services Assessments are undertaken by the Aged Care Assessment Team

The tax cuts introduced from July 1 and other changes may mean it’s time for a review of your current tax, super and investment strategies

Gold prices have been climbing strongly in 2024 as investors, jittery about the effects of wars in the Middle East and Ukraine, buy up the

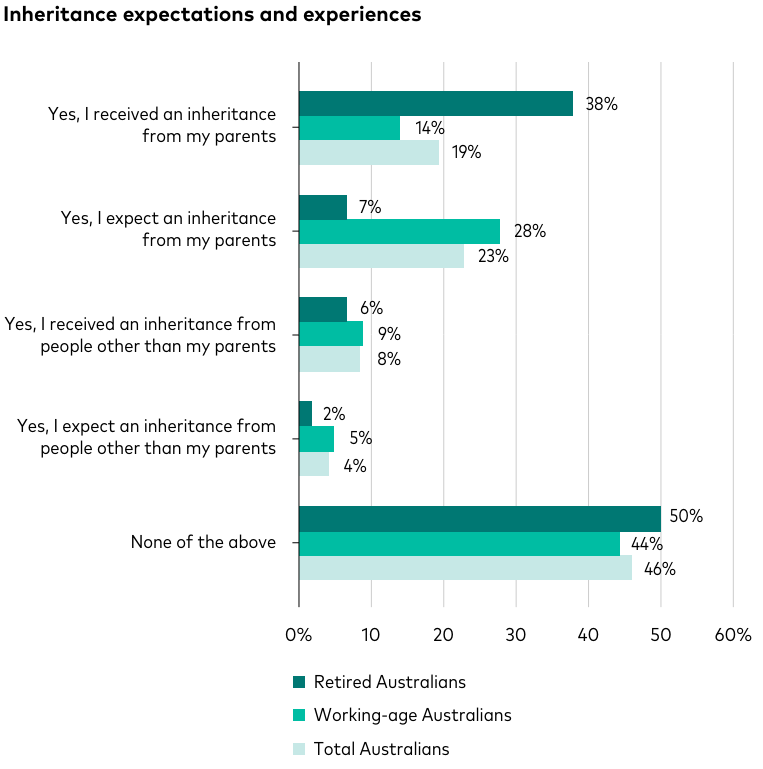

Many Australians expect an inheritance, but their parents may have a different view. Around one in two Australians have received or expect to inherit money

How to dispose of shares You can dispose of your shares in the following ways: selling them giving them away (gifting shares) transferring them to

Key takeaways Salary sacrificing into super involves redirecting a portion of your pre-tax salary into your super fund One of the primary advantages of salary

Why the decision to keep deeming rates on hold may be a window for interest rates. In delivering the second reading of the Appropriation Bill

What is your ‘estate’? Your ‘estate’ includes everything you own – your ‘earthly possessions’, if you will. It can include for example cash, property, cars,

Average household wealth, and what it takes to rank among Australia’s wealthiest 1%. Being a billionaire isn’t what it used to be. Back in 1990,

Discover why having a core-satellite approach to your portfolio is a powerful investment tool. What is a core-satellite strategy and why is it so powerful?